The False Claims Act can be a powerful tool to combat fraud, waste and abuse, but it is often misunderstood and used ineffectively. I was a federal prosecutor who worked on multiple criminal and civil cases involving the False Claims Act and I’ve also worked on these cases in private practice, and I wanted to provide this guide to the False Claims Act for non-lawyers.

What is a False Claims Act case?

The federal government can bring a civil lawsuit under the False Claims Act (“FCA”) against anyone who has presented a false or fraudulent claim to a government program. This is one of many tools available to the government, and it has advantages and disadvantages compared to other tools.

For the government, one advantage of bringing a case under the False Claims Act is that the government has a lower standard of proof (preponderance of the evidence) compared to criminal cases (beyond a reasonable doubt). Another advantage is that the government can sometimes get more money back in FCA cases than it can in criminal cases or in administrative audits – FCA cases result in civil penalties of at least $5,000 per false claim in addition to three times the damages suffered by the government.

At the same time, FCA cases have limits, especially compared to the criminal cases that I primarily handled. First, the government cannot use certain investigative techniques such as grand juries and undercover recordings in FCA cases. Second, there is no possibility of jail time as a penalty, which hopefully is some comfort to those who have been sued under the FCA.

What is a “qui tam” or whistleblower case?

The federal government can bring an FCA case on its own, but most FCA cases now are initiated by private individuals who act as “relators” and bring lawsuits in the name of the United States. Lawsuits brought by individuals on behalf of the United States are called “qui tam” or whistleblower lawsuits, and these lawsuits have increased dramatically in number and significance over the past few decades.

For the government, the advantage of a “qui tam” lawsuit is that private individuals have a financial incentive to develop strong cases of fraud, waste and abuse in government programs. As a result, the government has recovered money in some cases that it would not have known about otherwise.

On the other hand, this financial incentive can also bring out people who may not have strong cases. This can distract the government and waste time and resources from better cases that the government could develop on its own.

Most “qui tam” lawsuits are brought by former employees who have inside knowledge of how a fraud was working and may have tried to stop the fraud, but who also may have baggage that affects their credibility.

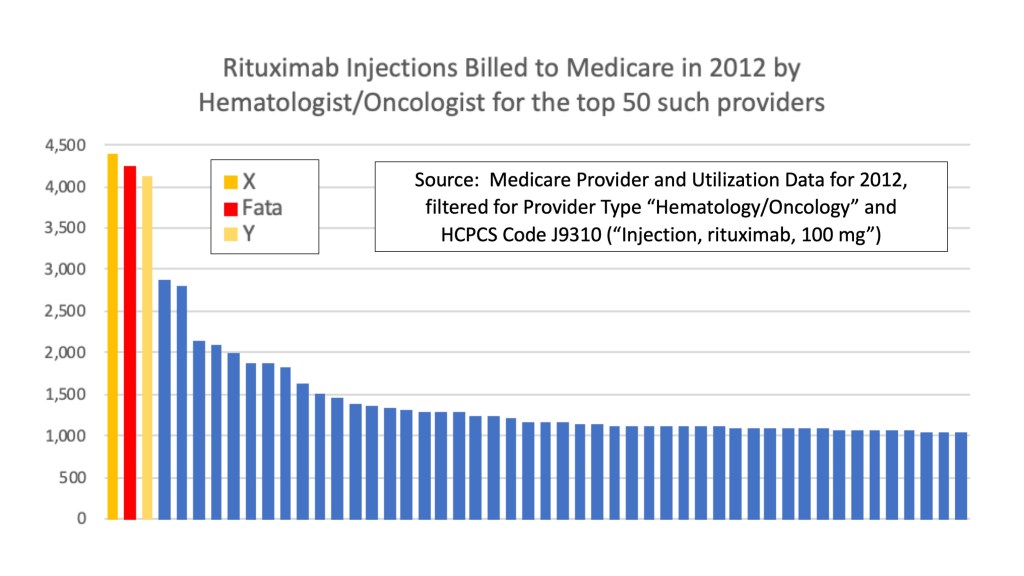

At the same time, nothing in the False Claims Act limits relators to former employees – any person can bring a “qui tam” case if they have non-public information about false claims. In recent years, some “qui tam” cases have been brought by individuals or companies that realized what their competitors were doing. Publicly-available data also can be mined to develop potential False Claims Act cases, though data alone is probably not enough to bring a case.

What happens when a “qui tam” case is filed?

A relator, usually via a lawyer, begins a case by filing a complaint in federal court under seal. The government then has at least 60 days (usually much more) to decide whether the government wants to “intervene” in the case, basically taking over the lawsuit. During that time, the government investigates the case, often via law-enforcement agents such as special agents at the FBI or the Department of Health and Human Services – Office of Inspector General.

In my experience, the first steps by the government in an FCA case were typically (1) interview the relator and review any materials that the relator provides and (2) pull the claims data. Data helps the government determine whether there is any substance to the allegations. I’ve used data to quickly corroborate allegations, and I’ve also used data to show that the allegations were weak and did not warrant further investigation.

After investigating, the government has to make a decision about how to proceed:

- The government could decide to “intervene” in the lawsuit, basically taking over part or all of the lawsuit from the relator. In this situation, the government can conduct discovery as in a civil case and will probably try to reach a settlement or go to trial.

- The government could decide that the allegations are serious enough to warrant criminal prosecution, as happened in many cases that I worked on. The “qui tam” lawsuit often is put on hold while the criminal case proceeds.

- The government could decide to not intervene in the lawsuit. Relators then are allowed to pursue the lawsuit on their own. Some relators pursue their cases and can win large awards. But many cases fail without the resources and tools that the government has available.

- The government can also decide that the allegations are meritless and dismiss the lawsuit entirely.

What kinds of cases are brought under the False Claims Act?

Most “qui tam” cases relate to a federal health care program such as Medicare, Medicaid, or TRICARE. In the 2010s, about 70 percent of new “qui tam” cases each year related to federal health care programs, a big change from the late 1980s and early 1990s when most cases related to the Department of Defense.

Looking back over the cases that have resulted in settlements or judgments in 2020, here are some common types of health care FCA cases:

- Unnecessary services. Services typically should be billed to a health care program or insurer only if the services were medically necessary (preventative care generally is not covered). Accordingly, if Medicare is paying for a service that was not medically necessary, the government views that as a false claim. For example, in 2020, there were several cases involving unnecessary tests, such as cases where patients were automatically given urine drug tests without any determination of necessity.

- Upcoding. Services typically are billed based on the patients’ need and the complexity of services performed. “Upcoding” is a term for services that are billed as if they were more complicated than they actually were, typically so the provider can get more money than he or she should. In 2020, there were multiple cases involving skilled nursing facilities that billed as if patients were receiving the highest level of services even when they did not need such services. There was also a case involving the billing of work done by nurse practitioners at the higher reimbursement rate associated with doctors.

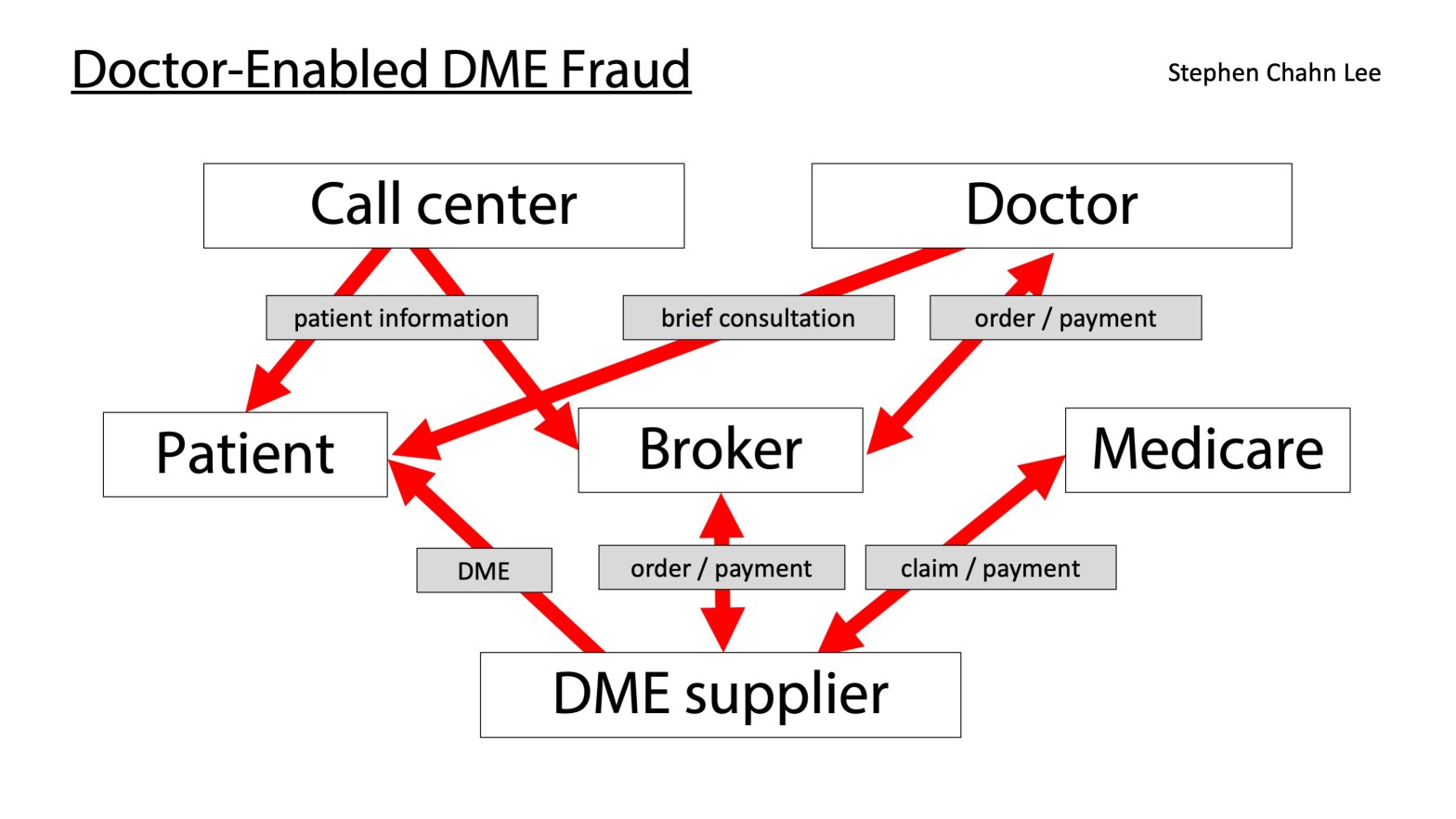

- Kickbacks. Financial incentives that violate the Anti-Kickback Statute can render a claim “false” for purposes of the False Claims Act. In 2020, there were cases involving multiple types of kickbacks: (1) sham medical director agreements, (2) payments to referring physicians based on the volume or value of referrals, and (3) free phone services or advertising assistance. Some cases also involve violations of the Stark law, which generally prohibits physicians from referring patients to entities with which they have a financial relationship.

How do people know that there is a “qui tam” lawsuit filed against them?

Because cases are filed under seal, people probably will not know there is a “qui tam” lawsuit filed against them until they are served with a complaint and summons, which may occur years after the initial filing.

Still, there are some signs that the government is conducting a covert investigation based on a “qui tam” lawsuit. One sign is if you receive a “civil investigative demand” for documents or testimony. Another sign is if you learn that agents are interviewing former employees – interviewing current employees can trigger ethical obligations that can limit investigative steps, but interviewing former employees is a common investigative technique.

What kind of defenses are there to a “qui tam” lawsuit?

Individuals and companies who are faced with a “qui tam” lawsuit can and should evaluate the allegations carefully to determine how to defend themselves. Here are some common defenses:

- The claims were not false. A difference in medical opinion is generally not enough to render a claim false or fraudulent. To prove that a claim is false or fraudulent, the government or relator should show that the services were not actually rendered, that the provider did not actually believe that the patient actually had the diagnosed condition, or that no reasonable provider could have concluded that the service was necessary or that the patient had the diagnosed condition. Some courts also allow lawsuits based on the idea that the services, though rendered, were so substandard and “worthless” that the claims for those services were effectively false.

- Errors or problems were not done “knowingly.” Mistakes happen frequently in medical billing, and mistakes should be handled through audits, not through the FCA. In an FCA case, the government or relator must prove that the defendants (1) had “actual knowledge” that a claim was false, (2) acted in “deliberate ignorance of the truth or falsity” of the claim, or (3) acted in “reckless disregard of the truth or falsity” of the claim.

- The allegations in a complaint are too vague. In an FCA case, the government or relator must “state with particularity the circumstances constituting fraud or mistake” in their complaint. Vague allegations are not enough, and complaints sometimes can be dismissed if the relator cannot connect their allegations to a specific false claim.

- The allegations relate to errors or problems that are immaterial. Minor problems with how services are rendered are not significant or “material” enough to give rise to an FCA case. For example, if a hospital fails to comply with some government or contractual requirement, that does not necessarily render every claim it has submitted false.

Another defense is to limit the “damages” that the government or relator can prove. One false claim does not mean that every claim is false. In FCA cases, the government is not required to review every claim at issue, but can prove damages in other ways. Typically, this involves an expert reviewing a “sample” of claims and a statistician extrapolating from the expert’s review against the larger “universe” of claims. Defendants can challenge the expert’s conclusions and should check whether the extrapolation is done correctly.

Defendants in “qui tam” cases should keep in mind some warnings.

- First, do not disregard an FCA case just because the relator was fired or left on bad terms or is a competitor. Successful FCA cases rarely rely on a single witness, and the government can build a case around the allegations of someone even if that person would be a terrible witness at trial or does not even get called at trial. In fact, firing employees who raise concerns can give rise to retaliation claims under the FCA and can even become powerful evidence of criminal intent.

- Second, even if the government decides to handle a case civilly, the government can sometimes still bring criminal charges, especially if the government learns or believes that files have been falsified in response to a civil investigative demand or audit.

- Third, even if the government decides not to intervene, the government sometimes can intervene later, particularly if a relator develops significant new information in discovery.

What can someone get for becoming a relator?

Relators can get a share of the money that the government gets back via a False Claims Act, typically ranging from 15 percent to 25 percent, more if the government does not intervene. If there are multiple relators who have filed separate lawsuits, recovery is generally limited to the first relator who brings an action, which creates an incentive to file early.

In 2020, relators in health care FCA cases that the government handled and that resulted in settlements got awards ranging from $58,087 for a case involving upcoded services to $10 million for a former hospital executive who reported violations of the Anti-Kickback Statute.

But potential relators should consider the following before bringing a “qui tam” case.

- First, vague allegations of problems are not going to be enough, given the defenses discussed above. Isolated problems are also not going to be enough, given the amount of resources that bringing a successful case can take.

- Second, these cases can take a long time. Several cases that resulted in settlements in 2020 were filed in 2011, 2012, and 2013, meaning that relators waited a long time before receiving anything.

- Third, relators get nothing if the case does not result in a settlement or judgment. Good cases sometimes end up with no recovery because of problems in how the case was investigated or handled. Relators can even be ordered to pay attorneys’ fees if the government does not intervene, if the defendant prevails at trial, and if a court finds that the claim was “clearly frivolous, clearly vexatious, or brought primarily for purposes of harassment.”

- Fourth, if you were part of a fraud, becoming a relator does not automatically immunize you from prosecution. Going along with a fraud for years and then filing a “qui tam” complaint is very risky.

- And finally, if your goal is to stop an ongoing fraud, there may be more efficient and effective ways of doing so, such as calling a tip line with a Medicare contractor, the FBI or HHS-OIG. You might be able to maintain your anonymity and you might even have more credibility as a witness if you do not have a financial incentive in the outcome of the case.

Hope this helps. If you have additional questions specific to your situation, consider consulting and retaining an attorney.

Stephen Lee was an Assistant United States Attorney in Chicago from 2008 through 2019 and served as senior counsel to the healthcare fraud unit in the U.S. Attorney’s Office for the Northern District of Illinois. He is now in private practice in Chicago. In his first year in private practice, he was counsel to a doctor in a seven-week Medicare Strike Force trial in the Southern District of Texas, in which he helped win the acquittal and dismissal of multiple charges, including all charges against three co-defendants.